Well, YOU DO!

Here's 3 reason's why you MUST understand Financial Statements: -

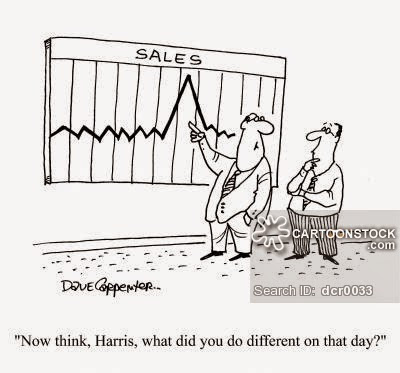

1. Knowing the 'stories' behind the numbers

Being able to understand Financial Statements (i.e. The Balance Sheet, Profit & Loss Statement and Cash Flow Statement) is extremely important as the numbers in the Financial Statements tell a 'story' about the financial "health", profitability and the cash flows of a business or company.

It also allows you to track the performance of one company over a few years as well as compare the performance of two companies over the same year. So remember, Financial Statements are not only published for the 'entertainment' of bankers and stockbrokers! You should use them too!

2. Making informed business decisions

If you are a business owner, understanding Financial Statements not only allows you to know how your business is doing (e.g. is it making profit or losing money), it also allows you to assess the current situation of the business and decide on the future plans to improve it. For example you might like run some cost cutting measures or control your business' finances.

Many business owners tend to shy away from understanding their Financial Statements, but they must realise that it is actually the key to understanding your business.

3. Investing based on facts, not feelings

Many stock investors enter into investing decisions (buy, sell or hold stock) based on news or rumours they've heard in the marketplace, or based on their own "gut feeling". Investing this way may sometimes bring huge profits but it may also bring huge losses, and clearly not sustainable in the long run.

Warren Buffett was once asked "How do you know what stock to buy?" He answered "I read the financial statements!".

A very important part of every stock investor's research is using financial statement data and doing the something called "Fundamental Analysis". "Fundamental Analysis" is a technique that attempts to determine a stock's value by focusing on underlying factors that affect a company's actual business and its future prospects. Part of this technique involves Financial Ratio Analysis.

Are you a busines owner who wants get a feel of how "healthy" your busines or company is?

Are you a stock investor who needs a simple but effective tool to supplement your Fundamental Analysis?

"The DIY Financial Ratio Analysis Template" is designed to assist you in calculating and assessing the "health" of a company through financial ratio analysis.

The Template will allow you to: -

1. Calculate and assess 16 key financial ratios split into 4 categories: -

- Liquidity & Solvency ratios

- Efficiency ratios

- Profitability ratios

- Cash Flow Ratios

2. View key ratios in graphical format for easy visualisation

3. Assess the overall financial "health" of a company by assigning one of the following ratings: -

- Very Strong

- Strong

- Average

- Weak

4. Compare the assessment and ratings of up to 3 companies at the same time

Add this useful tool to assist you in understanding Financial Statements today!

Buy it now at https://sellfy.com/p/Y70E/

Or click here!