"Okay, I want to be my own "Accountant" and manage my money well. But...where do I start?"

Here's 3 simple steps: -

Step 1 - Create a monthly budget

Budget the amount of expected income you earn and expenses that you expect spend on a monthly basis. You may do this on a piece of paper, in a notebook or an Excel spreadsheet.

Split your income by your income streams (salary from employment, salary from own business, dividends, bonuses etc.)

Split your expenses by categories (house, car, food, clothing, one-offs etc.)

Step 2 - Track your actual daily expenses

Record your actual expenses on a daily basis. Again, this can be done on a piece of paper, in a notebook or an Excel spreadsheet.

Step 3 - Compare your results on a monthly basis

At the end of each month, compare the actual expenses incurred for that month (in Step 2) against the budget that you set earlier (in Step 1).

Look for areas which you had overspent your budget significantly. Identify any large or big-ticket expense items which resulted in you bursting your budget. Then work on cutting down spending on that the following month.

Sounds simple doesn't it? Good!

Would you like a spreadsheet or template that can help you do all the 3 steps above?

If so, The DIY Accountant has developed "The DIY Personal Income & Expenses Tracker" just for you.

It allows you to do Steps 1, 2 and 3 above as well as answer 3 key questions: -

1. Did I save or overspend?

If you've saved, well done! Keep it up!

If you've overspent, it's time to revisit the large or big-ticket Expense items which resulted in you overspending and work on cutting down on that next time

2. Did I spend in line with my budget?

If you've spent within your budget, well done! Keep it up!

If you've spent beyond your budget, it's time to revisit the large or big-ticket Expense items which resulted in you bursting your budget and work on cutting down on that next time

3. Did I spend in line with the Money Jars System?

Compare the actual percentages against the percentages recommended by the Money Jars System. Are the percentages different by more than a 10% range?

If so, it's time to reflect and adjust your spending to align with the recommended percentages.

If you are spending too much on necessities, then Simplify!

If your FFA (Financial Freedom Account) is too little, then start allocating more to put into it. In other words, Save and Invest more!

Buy it now at https://sellfy.com/p/MQU0/

Or click here! Buy now

The DIY Accountant

Friday, 12 June 2015

A Different Way To Look At Your Expenses

Expenses can be categorised to suit the Money Jar System. Think of all personal your expenses being split into 10 broad categories. I then fit each category into one of The 6 Money Jars.

Category 1 - Roof! - House related expenses

Money Jar: NEC ("Necessity")

Examples:

Category 2 - Ride! - Travel related expenses

Money Jar: NEC ("Necessity")

Examples:

Category 3 - Tummy! - Food related expenses

Money Jar: NEC ("Necessity")

Examples:

Category 4 - Fashion! - Clothing related expenses

Money Jar: NEC ("Necessity")

Examples:

Category 5 - Health! - Health related expenses

Money Jar: NEC ("Necessity")

Examples:

Category 6 - Learn! - Education related expenses

Money Jar: EDU ("Education")

Examples:

Category 7 - Play! - Enjoyment related expenses

Money Jar: PLAY ("Play")

Examples:

Category 8 - One-Offs! - Big ticket related expenses

Money Jar: LTSS ("Long Term Saving for Spending")

Examples:

Category 9 - Give! - Charity related expenses

Money Jar: GIVE ("Give")

Examples:

Category 10 - Invest! - Investment related expenses

Money Jar: FFA ("Financial Freedom Account")

Examples:

So, what does this all mean?

When you track your actual expenses by the 10 broad categories, it makes it a lot easier for you to keep track of the percentages that actually go into each of the 6 Money Jars.

You can then compare your actual percentages against the recommended percentages. If they differ by too much (let's say more than 10%), then it's time to reflect and adjust your spending to align with the recommended percentages.

If you are spending too much on necessities, then Simplify!

If your FFA account is too little, then start allocating more to put into it. In other words, Save and Invest more!

Category 1 - Roof! - House related expenses

Money Jar: NEC ("Necessity")

Examples:

- If own home - Loan / mortgage repayments

- If renting - Rental payments

- Utilities - Water, Electricity, Gas, Phone, Broadband / Internet etc

- TV licence

- Taxes - Council / quit rent / assessment

- Repairs and maintenance

- Home insurance

Home Sweet Home!

Category 2 - Ride! - Travel related expenses

Money Jar: NEC ("Necessity")

Examples:

- If own car - Loan repayments

- If don't drive - Public transport

- Fuel - Petrol / diesel

- Road tax

- Parking

- Toll charges

- Repairs and maintenance

- Car insurance

Baby you can drive my car!

Category 3 - Tummy! - Food related expenses

Money Jar: NEC ("Necessity")

Examples:

- Meals

- Groceries

Okay, John, stop playing with your food...

Category 4 - Fashion! - Clothing related expenses

Money Jar: NEC ("Necessity")

Examples:

- Clothing / shoes / accessories

Category 5 - Health! - Health related expenses

Money Jar: NEC ("Necessity")

Examples:

- Medical

- Dental

- Optical

- Toiletries

- Personal insurance

Do you choose to take the blue pill or the white pill?

Category 6 - Learn! - Education related expenses

Money Jar: EDU ("Education")

Examples:

- Tuition

- Study loan

- Classes / lessons

- Seminars

- Books / magazines / newspapers

Category 7 - Play! - Enjoyment related expenses

Money Jar: PLAY ("Play")

Examples:

- Party!

- Food and drinks

- Toy / games

Category 8 - One-Offs! - Big ticket related expenses

Money Jar: LTSS ("Long Term Saving for Spending")

Examples:

- Holidays - Flights, Hotels, Travel, Meals etc

- Celebrations - Birthdays / Weddings etc

- Festive occasions - Christmas etc

- New furniture

- New electricals

- New laptop

- New mobile phone

Alright, Santa! You can have ALL my money!

Category 9 - Give! - Charity related expenses

Money Jar: GIVE ("Give")

Examples:

- Donations

- Supported charities

Category 10 - Invest! - Investment related expenses

Money Jar: FFA ("Financial Freedom Account")

Examples:

- Shares

- Bonds

- Unit trusts

- Mutual funds

- Investment property - Loan / mortgage repayments, management fees, repairs and maintenance etc

- Savings

So, what does this all mean?

When you track your actual expenses by the 10 broad categories, it makes it a lot easier for you to keep track of the percentages that actually go into each of the 6 Money Jars.

You can then compare your actual percentages against the recommended percentages. If they differ by too much (let's say more than 10%), then it's time to reflect and adjust your spending to align with the recommended percentages.

If you are spending too much on necessities, then Simplify!

If your FFA account is too little, then start allocating more to put into it. In other words, Save and Invest more!

The 6 "Jars" That Could Change Your Life

T. Harv Eker in his book "Secrets Of The Millionaire Mind" introduced the most effective Money Management System.

It's called the Money Jar System or The 6 Jars. Basically, your net income (after all deductions e.g. income tax, social security etc) should be divided into 6 Jars at different recommended percentages or proportions.

Each of the 6 Jars would serve different functions. Ideally, you should create separate bank accounts to put the recommended proportion into each of these jars and also withdraw money from each bank account (or Jar) so that you can track the actual amount spent.

The 6 Jars are: -

Jar No. 1 - The Necessity Jar ("NEC")

This account is for managing your everyday expenses and bills. This would include things like your rent, mortgage, utilities, bills, taxes, food, clothes, etc. Basically it includes anything that you need to live, the necessities.

The recommended percentage for this Jar is 55% of your net income.

Jar No. 2 - The Education Jar ("EDU")

Money in this jar is meant to further your education and personal growth. An investment in yourself is a great way to use your money. You are your most valuable asset. Never forget this. Education money can be used to purchase books, CD’s, courses or anything else that has educational value.

The recommended percentage for this Jar is 10% of your net income.

Jar No. 3 - The Play Jar ("PLAY")

Money in this jar is spent every month on purchases you wouldn’t normally make. The purpose of this jar is to nurture yourself. You could purchase an expensive bottle of wine at dinner, get a massage or go on a weekend getaway. Play can be anything your heart desires. You and a spouse can each receive your own play money, and not even ask what the other person spends it on! Definitely my personal favourite Jar!

The recommended percentage for this Jar is 10% of your net income.

Jar No. 4 - The Long-Term Saving for Spending Jar ("LTSS")

Money in this jar is for bigger, nice-to-have purchases. Use the money for vacations, extravagances, a plasma TV, contingency fund, your children's education etc. A small monthly contribution can go a long way. You may have more than one LTSS jar. If you have more than one LTSS, divide the recommended percentage between the jars according to your priorities.

The recommended percentage for this Jar is 10% of your net income.

Jar No. 5 - The Give Jar ("GIVE")

Money in this jar is for giving away. Use the money for donations or give it to your favorite supported charity. The joy of giving brings meaning to your life and adds value to the lives of the people that you are helping.

The recommended percentage for this Jar is 5% of your net income.

Jar No. 6 - The Financial Freedom Account Jar ("FFA")

This is your golden goose. This jar is your ticket to financial freedom. The money that you put into this jar is used for investments and building your passive income streams. You never spend this money. The only time you would spend this money is once you become financially free. Even then you would only spend the returns on your investment. Never spend the principal.

The recommended percentage for this Jar is 10% of your net income.

It's called the Money Jar System or The 6 Jars. Basically, your net income (after all deductions e.g. income tax, social security etc) should be divided into 6 Jars at different recommended percentages or proportions.

Each of the 6 Jars would serve different functions. Ideally, you should create separate bank accounts to put the recommended proportion into each of these jars and also withdraw money from each bank account (or Jar) so that you can track the actual amount spent.

...and No! It's not this "Jar"!

The 6 Jars are: -

Jar No. 1 - The Necessity Jar ("NEC")

This account is for managing your everyday expenses and bills. This would include things like your rent, mortgage, utilities, bills, taxes, food, clothes, etc. Basically it includes anything that you need to live, the necessities.

The recommended percentage for this Jar is 55% of your net income.

Was that Bare Necessities or Bear Necessities?

Jar No. 2 - The Education Jar ("EDU")

Money in this jar is meant to further your education and personal growth. An investment in yourself is a great way to use your money. You are your most valuable asset. Never forget this. Education money can be used to purchase books, CD’s, courses or anything else that has educational value.

The recommended percentage for this Jar is 10% of your net income.

Jar No. 3 - The Play Jar ("PLAY")

Money in this jar is spent every month on purchases you wouldn’t normally make. The purpose of this jar is to nurture yourself. You could purchase an expensive bottle of wine at dinner, get a massage or go on a weekend getaway. Play can be anything your heart desires. You and a spouse can each receive your own play money, and not even ask what the other person spends it on! Definitely my personal favourite Jar!

The recommended percentage for this Jar is 10% of your net income.

Hmmm...I wonder what this "Grand Theft Auto" is all about?

Jar No. 4 - The Long-Term Saving for Spending Jar ("LTSS")

Money in this jar is for bigger, nice-to-have purchases. Use the money for vacations, extravagances, a plasma TV, contingency fund, your children's education etc. A small monthly contribution can go a long way. You may have more than one LTSS jar. If you have more than one LTSS, divide the recommended percentage between the jars according to your priorities.

The recommended percentage for this Jar is 10% of your net income.

Jar No. 5 - The Give Jar ("GIVE")

Money in this jar is for giving away. Use the money for donations or give it to your favorite supported charity. The joy of giving brings meaning to your life and adds value to the lives of the people that you are helping.

The recommended percentage for this Jar is 5% of your net income.

Jar No. 6 - The Financial Freedom Account Jar ("FFA")

This is your golden goose. This jar is your ticket to financial freedom. The money that you put into this jar is used for investments and building your passive income streams. You never spend this money. The only time you would spend this money is once you become financially free. Even then you would only spend the returns on your investment. Never spend the principal.

The recommended percentage for this Jar is 10% of your net income.

Ooo...that's some nice eggs you've got there!

3 Reasons Why You MUST Manage Your Money

"Are you tired of not having enough money or any savings at the end of each month?

Are you sick of having your monthly paycheck "disappearing" as soon as you get it?

Are you tired of spending beyond your means?

Are you sick of getting slapped by huge credit card bills which you can't afford to pay?"

Then, perhaps it's time to be your own "Accountant" and start managing your money!

Why is it so important for you to manage your money? Well, here's 3 reasons why: -

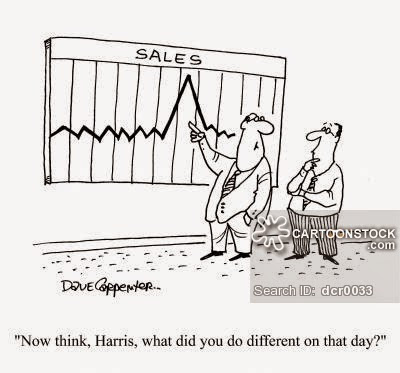

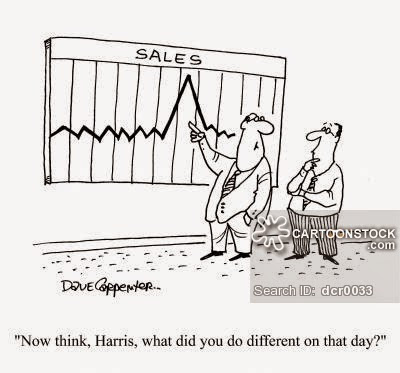

1. Create awareness

"If you don't know the root of the problem, how do you even begin to fix it?"

Managing your money creates awareness of your finances, helps you see where your money goes, how it is spent and identifies any spending issues that you may have. For example, if you are aware that you are spending too much on luxury goods or impulse shopping, which leads to HUGE credit card bills, then it's time to cut down expenses in that area.

2. Take control of your finances

"Now that you know what the problem is, it's time to fix it"

Once you know which areas you need to cut down your expenses on, then it's time to focus on that and start to change spending habits. Create a monthly budget and track your actual expenses against that budget. If your actual spending gets too close to your budget, that's where you have to "pinch" yourself and control yourself from overspending.

3. Your first step to financial freedom

"If you fix it well, it becomes a habit, and that's the first step to financial freedom"

Once your spending patterns have improved, then you will automatically develop a habit of saving or not overspending. You will learn to allocate your income to the right places (for example investments) and move them away from the wrong places (impulse buys or luxury goods). This also creates discipline in your spending which will contribute to your financial freedom.

Are you sick of having your monthly paycheck "disappearing" as soon as you get it?

Are you tired of spending beyond your means?

Are you sick of getting slapped by huge credit card bills which you can't afford to pay?"

Then, perhaps it's time to be your own "Accountant" and start managing your money!

Why is it so important for you to manage your money? Well, here's 3 reasons why: -

1. Create awareness

"If you don't know the root of the problem, how do you even begin to fix it?"

Managing your money creates awareness of your finances, helps you see where your money goes, how it is spent and identifies any spending issues that you may have. For example, if you are aware that you are spending too much on luxury goods or impulse shopping, which leads to HUGE credit card bills, then it's time to cut down expenses in that area.

2. Take control of your finances

"Now that you know what the problem is, it's time to fix it"

Once you know which areas you need to cut down your expenses on, then it's time to focus on that and start to change spending habits. Create a monthly budget and track your actual expenses against that budget. If your actual spending gets too close to your budget, that's where you have to "pinch" yourself and control yourself from overspending.

3. Your first step to financial freedom

"If you fix it well, it becomes a habit, and that's the first step to financial freedom"

Once your spending patterns have improved, then you will automatically develop a habit of saving or not overspending. You will learn to allocate your income to the right places (for example investments) and move them away from the wrong places (impulse buys or luxury goods). This also creates discipline in your spending which will contribute to your financial freedom.

Friday, 15 May 2015

3 Reasons Why You MUST Understand Financial Statements

"Financial Statements? Naah! They're not for me. They're too complicated, full of jargon and don't make any sense, except to bankers or stockbrokers. Who needs to understand them anyway?"

Well, YOU DO!

Here's 3 reason's why you MUST understand Financial Statements: -

1. Knowing the 'stories' behind the numbers

Being able to understand Financial Statements (i.e. The Balance Sheet, Profit & Loss Statement and Cash Flow Statement) is extremely important as the numbers in the Financial Statements tell a 'story' about the financial "health", profitability and the cash flows of a business or company.

It also allows you to track the performance of one company over a few years as well as compare the performance of two companies over the same year. So remember, Financial Statements are not only published for the 'entertainment' of bankers and stockbrokers! You should use them too!

2. Making informed business decisions

If you are a business owner, understanding Financial Statements not only allows you to know how your business is doing (e.g. is it making profit or losing money), it also allows you to assess the current situation of the business and decide on the future plans to improve it. For example you might like run some cost cutting measures or control your business' finances.

Many business owners tend to shy away from understanding their Financial Statements, but they must realise that it is actually the key to understanding your business.

3. Investing based on facts, not feelings

Many stock investors enter into investing decisions (buy, sell or hold stock) based on news or rumours they've heard in the marketplace, or based on their own "gut feeling". Investing this way may sometimes bring huge profits but it may also bring huge losses, and clearly not sustainable in the long run.

Warren Buffett was once asked "How do you know what stock to buy?" He answered "I read the financial statements!".

A very important part of every stock investor's research is using financial statement data and doing the something called "Fundamental Analysis". "Fundamental Analysis" is a technique that attempts to determine a stock's value by focusing on underlying factors that affect a company's actual business and its future prospects. Part of this technique involves Financial Ratio Analysis.

Are you a busines owner who wants get a feel of how "healthy" your busines or company is?

Are you a stock investor who needs a simple but effective tool to supplement your Fundamental Analysis?

"The DIY Financial Ratio Analysis Template" is designed to assist you in calculating and assessing the "health" of a company through financial ratio analysis.

The Template will allow you to: -

1. Calculate and assess 16 key financial ratios split into 4 categories: -

2. View key ratios in graphical format for easy visualisation

3. Assess the overall financial "health" of a company by assigning one of the following ratings: -

4. Compare the assessment and ratings of up to 3 companies at the same time

Add this useful tool to assist you in understanding Financial Statements today!

Buy it now at https://sellfy.com/p/Y70E/

Or click here!

Buy now

Well, YOU DO!

Here's 3 reason's why you MUST understand Financial Statements: -

1. Knowing the 'stories' behind the numbers

Being able to understand Financial Statements (i.e. The Balance Sheet, Profit & Loss Statement and Cash Flow Statement) is extremely important as the numbers in the Financial Statements tell a 'story' about the financial "health", profitability and the cash flows of a business or company.

It also allows you to track the performance of one company over a few years as well as compare the performance of two companies over the same year. So remember, Financial Statements are not only published for the 'entertainment' of bankers and stockbrokers! You should use them too!

2. Making informed business decisions

If you are a business owner, understanding Financial Statements not only allows you to know how your business is doing (e.g. is it making profit or losing money), it also allows you to assess the current situation of the business and decide on the future plans to improve it. For example you might like run some cost cutting measures or control your business' finances.

Many business owners tend to shy away from understanding their Financial Statements, but they must realise that it is actually the key to understanding your business.

3. Investing based on facts, not feelings

Many stock investors enter into investing decisions (buy, sell or hold stock) based on news or rumours they've heard in the marketplace, or based on their own "gut feeling". Investing this way may sometimes bring huge profits but it may also bring huge losses, and clearly not sustainable in the long run.

Warren Buffett was once asked "How do you know what stock to buy?" He answered "I read the financial statements!".

A very important part of every stock investor's research is using financial statement data and doing the something called "Fundamental Analysis". "Fundamental Analysis" is a technique that attempts to determine a stock's value by focusing on underlying factors that affect a company's actual business and its future prospects. Part of this technique involves Financial Ratio Analysis.

Are you a busines owner who wants get a feel of how "healthy" your busines or company is?

Are you a stock investor who needs a simple but effective tool to supplement your Fundamental Analysis?

"The DIY Financial Ratio Analysis Template" is designed to assist you in calculating and assessing the "health" of a company through financial ratio analysis.

The Template will allow you to: -

1. Calculate and assess 16 key financial ratios split into 4 categories: -

- Liquidity & Solvency ratios

- Efficiency ratios

- Profitability ratios

- Cash Flow Ratios

2. View key ratios in graphical format for easy visualisation

3. Assess the overall financial "health" of a company by assigning one of the following ratings: -

- Very Strong

- Strong

- Average

- Weak

4. Compare the assessment and ratings of up to 3 companies at the same time

Add this useful tool to assist you in understanding Financial Statements today!

Buy it now at https://sellfy.com/p/Y70E/

Or click here!

3 Reasons Why You DON'T Need To Hire An Accountant

If you own a small business and someone asks you to prepare your own accounts and financial statements, what thoughts would go through your mind?

"I don't think accounting is for me, it's too complicated and I don't understand it!"

"I don't want to get involved in all those messy numbers and figures!"

"I don't want to learn all those Debits and Credits, what a waste of time!"

"I don't have time for this!"

So what do you do? You go out and hire an accountant to prepare your accounts for you. The accountant then charges you a fee, which is an extra cost to your business.

But wait! Is there another way?

Well, YES!

You actually DON'T need to hire an accountant and here's 3 reasons why: -

1. Your business is small and simple

If you own a small and simple business, then there's a strong chance that you don't need to hire an accountant because you can easily prepare your accounts and financial statements on your own. Small businesses tend to have a limited number of transactions per month which can be easily recorded and self-managed. You can literally DIY it!

2. Be in control of your own business finances

Preparing your own accounts and financial statements will give you a great overview of your business and allows you to be in control of your business finances. You will know the financial impact of every transaction and be able to make the right business decisions. Why give all that information to someone else, like say, an accountant, when you can DIY it?

3. Save money

Accountants may charge a substantial fee just to prepare a simple set of accounts and financial statements for your business. This cost may not justified as you could save that money and reinvest it to grow your business. If your business is small and simple, then preparing accounts shouldn't cost you a fortune. DIY it and watch the savings come through!

"Great! I don't need an accountant to prepare my accounts! I will DIY it! But where do I start?"

Everyone knows that to build a piece of furniture, you'll need the right tools (hammer, nails, screwdriver etc). Likewise, to prepare your accounts and financial statements, you'll need the right tools!

"The DIY Accounting Template" is designed to assist owners of small and simple businesses (for example, buying and selling trendy clothes on the Internet, selling tasty hot dogs at a food stand, selling unique paintings at a flea market, baking and selling custom-made cakes etc) in preparing their accounts and financial statements.

You may purchase this spreadsheet for only a fraction of the cost of hiring an actual accountant.

The Template will allow you to: -

1. Prepare and record a monthly transaction list - No worrying about double entries or DEBITS and CREDITS, it's all done automatically!

2. Keep track and manage your stock balances - How much stock do I have left?

3. Keep track and manage your customer balances - Who owes me money?

4. Keep track and manage your supplier balances - Who do I owe money to?

5. Get an overview of your sales by customer - Who are my top 5 largest customers by sales value?

6. Get an overview of my business expenses - Where did I spend most of my expenses on?

7. Generate your year end financial statements - The Balance Sheet and Profit & Loss Statement, all done automatically!

You will also receive online support via email from a qualified accountant, who will guide and assist you if you have any questions.

Be in control of your accounts and most importantly, save money!

Buy it now at https://sellfy.com/p/MbsS/

Or click here! Buy now

"I don't think accounting is for me, it's too complicated and I don't understand it!"

"I don't want to get involved in all those messy numbers and figures!"

"I don't want to learn all those Debits and Credits, what a waste of time!"

"I don't have time for this!"

So what do you do? You go out and hire an accountant to prepare your accounts for you. The accountant then charges you a fee, which is an extra cost to your business.

But wait! Is there another way?

Well, YES!

You actually DON'T need to hire an accountant and here's 3 reasons why: -

1. Your business is small and simple

If you own a small and simple business, then there's a strong chance that you don't need to hire an accountant because you can easily prepare your accounts and financial statements on your own. Small businesses tend to have a limited number of transactions per month which can be easily recorded and self-managed. You can literally DIY it!

2. Be in control of your own business finances

Preparing your own accounts and financial statements will give you a great overview of your business and allows you to be in control of your business finances. You will know the financial impact of every transaction and be able to make the right business decisions. Why give all that information to someone else, like say, an accountant, when you can DIY it?

3. Save money

Accountants may charge a substantial fee just to prepare a simple set of accounts and financial statements for your business. This cost may not justified as you could save that money and reinvest it to grow your business. If your business is small and simple, then preparing accounts shouldn't cost you a fortune. DIY it and watch the savings come through!

"Great! I don't need an accountant to prepare my accounts! I will DIY it! But where do I start?"

Everyone knows that to build a piece of furniture, you'll need the right tools (hammer, nails, screwdriver etc). Likewise, to prepare your accounts and financial statements, you'll need the right tools!

"The DIY Accounting Template" is designed to assist owners of small and simple businesses (for example, buying and selling trendy clothes on the Internet, selling tasty hot dogs at a food stand, selling unique paintings at a flea market, baking and selling custom-made cakes etc) in preparing their accounts and financial statements.

You may purchase this spreadsheet for only a fraction of the cost of hiring an actual accountant.

The Template will allow you to: -

1. Prepare and record a monthly transaction list - No worrying about double entries or DEBITS and CREDITS, it's all done automatically!

2. Keep track and manage your stock balances - How much stock do I have left?

3. Keep track and manage your customer balances - Who owes me money?

4. Keep track and manage your supplier balances - Who do I owe money to?

5. Get an overview of your sales by customer - Who are my top 5 largest customers by sales value?

6. Get an overview of my business expenses - Where did I spend most of my expenses on?

7. Generate your year end financial statements - The Balance Sheet and Profit & Loss Statement, all done automatically!

You will also receive online support via email from a qualified accountant, who will guide and assist you if you have any questions.

Be in control of your accounts and most importantly, save money!

Buy it now at https://sellfy.com/p/MbsS/

Or click here! Buy now

Thursday, 7 May 2015

Lesson #15 - Financial Ratios - How "Healthy" Is A Company Or Business?

Ever wondered how "healthy" a company or business is?

Just like a medical healthcheck has various indicators like heart rate, blood pressure, cholesterol levels etc, Financial Ratios are the indicators for a company or business. Ratios tell us whether the company or business is in great health or has critical health issues.

It also gives us a better overview of how the company or business is actually performing. In short, it helps us see the "Bigger Picture".

Great! So, where do I start?

Your starting point is knowing what Financial Ratios are, how to calculate the Ratios and what 'stories' these Ratios tell us.

The beauty of it is - All the figures required for calculating these ratios can be found inside the 'BIG 3' Financial Statements - The Balance Sheet, The Profit And Loss Statement and The Cash Flow Statement!

Tell me! Tell me! What are these "Ratios"?

Financial Ratios can be divided into 4 broad categories. These categories are presented below, together with the Ratios that sit within them. The purpose of each Ratio is then explained.

Liquidity & Solvency Ratios

It shows the company's ability to meet its short-term obligations. The higher the ratio, the better.

Quick Ratio

Similar to the Current Ratio. It shows the company's ability to meet its short-term obligations but using its most 'liquid' assets (i.e. near cash or quick assets, excluding inventory which usually takes longer to be converted into cash). The higher the ratio, the better.

Debt To Equity Ratio

It shows how the company is funded i.e. by Debt or by Equity and used as a standard for judging a company's financial standing. Too much debt may be a problem as it ties the company to interest payments and repayment of its loans and borrowings. A good balance of Debt and Equity is recommended.

Debt Ratio

Similar to the Debt To Equity Ratio. It shows how much the company relies on Debt to finance its Assets. The lower the ratio, the better.

Interest Coverage Ratio

It shows how easily a company can pay interest on outstanding Debts (i.e. loans and borrowings). The higher the ratio, the better.

Efficiency Ratios

Days Sales Outstanding (DSO)

It shows how many days a company takes to collect cash from customers, after a sale has been made. The lower the number of days, the better.

Days Inventory Outstanding (DIO)

It shows how many days a company takes to sell its inventory. The lower the number of days, the better.

Days Payables Outstanding (DPO)

It shows how many days a company takes to pay its suppliers. The higher the number of days, the better.

Cash Conversion Cycle (CCC)

It shows the combined effectiveness of the company to collect cash from customers, convert inventory into cash and to pay its suppliers. The lower the number of days, the better.

Profitability Ratios

Revenue Growth

It shows how much revenue has grown in the current period compared to the prior period. The higher the ratio, the better.

Return On Assets

It shows how effective the company is at using its assets to generate profits. The higher the ratio, the better.

Return On Equity

It shows how effective the company is at using the money invested by shareholders to generate profits. The higher the ratio, the better.

Net Profit Margin

It shows how much each dollar of revenue earned is translated into profits. The higher the ratio, the better.

Cash Flow Ratios

Operating Cash Flow

It shows how many dollars of cash you get for every dollar of sales. The higher the ratio, the better.

Asset Efficiency

It shows how well the company uses its assets to generate cash flow. The higher the ratio, the better.

Cash Generating Power

This is a complex ratio but probably one of the most powerful, hence its name!

It shows the company’s ability to generate cash purely from operations compared to the total cash inflow (i.e. ignoring cash outflows).

Note that instead of using both cash inflows and outflows

from Investing activities and from Financing activities, only cash inflows are used. Cash outflows are excluded. The higher the ratio, the better.

On that note, let's take you back to the 90's with a song called "The Power" by Snap!

Enjoy!

Just like a medical healthcheck has various indicators like heart rate, blood pressure, cholesterol levels etc, Financial Ratios are the indicators for a company or business. Ratios tell us whether the company or business is in great health or has critical health issues.

It also gives us a better overview of how the company or business is actually performing. In short, it helps us see the "Bigger Picture".

Great! So, where do I start?

Your starting point is knowing what Financial Ratios are, how to calculate the Ratios and what 'stories' these Ratios tell us.

The beauty of it is - All the figures required for calculating these ratios can be found inside the 'BIG 3' Financial Statements - The Balance Sheet, The Profit And Loss Statement and The Cash Flow Statement!

Tell me! Tell me! What are these "Ratios"?

Financial Ratios can be divided into 4 broad categories. These categories are presented below, together with the Ratios that sit within them. The purpose of each Ratio is then explained.

Liquidity & Solvency Ratios

Current Ratio

Current Ratio = Current Assets / Current Liabilities

It shows the company's ability to meet its short-term obligations. The higher the ratio, the better.

Quick Ratio

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Similar to the Current Ratio. It shows the company's ability to meet its short-term obligations but using its most 'liquid' assets (i.e. near cash or quick assets, excluding inventory which usually takes longer to be converted into cash). The higher the ratio, the better.

Wow! That was quick!

Debt To Equity Ratio

Debt To Equity Ratio = Total Liabilities / Shareholders' Equity

It shows how the company is funded i.e. by Debt or by Equity and used as a standard for judging a company's financial standing. Too much debt may be a problem as it ties the company to interest payments and repayment of its loans and borrowings. A good balance of Debt and Equity is recommended.

Debt Ratio

Debt Ratio = Total Liabilities / Total Assets

Similar to the Debt To Equity Ratio. It shows how much the company relies on Debt to finance its Assets. The lower the ratio, the better.

Interest Coverage Ratio

Interest Coverage Ratio = Operating Profit / Interest Expense

It shows how easily a company can pay interest on outstanding Debts (i.e. loans and borrowings). The higher the ratio, the better.

Efficiency Ratios

Days Sales Outstanding (DSO)

DSO = Trade Receivables / Revenue x 365

It shows how many days a company takes to collect cash from customers, after a sale has been made. The lower the number of days, the better.

Days Inventory Outstanding (DIO)

DIO = Inventory / Cost of Goods Sold x 365

It shows how many days a company takes to sell its inventory. The lower the number of days, the better.

Days Payables Outstanding (DPO)

DPO = Trade Payables / Cost of Goods Sold x 365

It shows how many days a company takes to pay its suppliers. The higher the number of days, the better.

Cash Conversion Cycle (CCC)

CCC = DIO + DSO - DPO

It shows the combined effectiveness of the company to collect cash from customers, convert inventory into cash and to pay its suppliers. The lower the number of days, the better.

Profitability Ratios

Revenue Growth

Revenue Growth = Current period Revenue / Prior period Revenue

It shows how much revenue has grown in the current period compared to the prior period. The higher the ratio, the better.

Return On Assets

Return On Assets = Net Income / Total Assets

It shows how effective the company is at using its assets to generate profits. The higher the ratio, the better.

Return On Equity

Return On Equity = Net Income / Shareholders' Equity

It shows how effective the company is at using the money invested by shareholders to generate profits. The higher the ratio, the better.

Net Profit Margin

Net Profit Margin = Net Income / Revenue

It shows how much each dollar of revenue earned is translated into profits. The higher the ratio, the better.

Cash Flow Ratios

Operating Cash Flow

Operating Cash Flow = Cash Flows From Operating Activities / Revenue

It shows how many dollars of cash you get for every dollar of sales. The higher the ratio, the better.

Asset Efficiency

Asset Efficiency = Cash Flows From Operating Activities / Total Assets

It shows how well the company uses its assets to generate cash flow. The higher the ratio, the better.

Cash Generating Power

Cash Generating Power = Cash Flows From Operating Activities / [Cash Flows From Operating Activities + Cash Flows From Investing Activities (Total of inflows only) +

Cash Flows From Financing Activities (Total of inflows only)]

This is a complex ratio but probably one of the most powerful, hence its name!

It shows the company’s ability to generate cash purely from operations compared to the total cash inflow (i.e. ignoring cash outflows).

Note that instead of using both cash inflows and outflows

from Investing activities and from Financing activities, only cash inflows are used. Cash outflows are excluded. The higher the ratio, the better.

On that note, let's take you back to the 90's with a song called "The Power" by Snap!

Enjoy!

Subscribe to:

Comments (Atom)